India’s startup ecosystem is a tale of glittering unicorns and grim ledgers. With 112 unicorns valued at $350 billion and a $450 billion digital economy, the headlines celebrate scale—$7.7 billion funding in 9M 2025, 195,065 DPIIT-recognized startups, and 17.6 lakh direct jobs. But the profitability puzzle is a stark reality check: Only 13-18 of India’s 100-125 unicorns are profitable, with 69% deep in losses and 57% bleeding heavily, according to Entrackr’s 2023 analysis of FY22 financials and RedSeer’s 2023 projection that just 50% will turn profitable by FY27.

From Byju’s $1,537 crore loss on sub-1/3 revenue to Swiggy’s $2,350 crore red ink and Oyo’s $1,000 crore bleed, these billion-dollar behemoths are “zombie unicorns”—surviving on investor lifelines while burning cash at rates that would make a rocket blush. The 2023-2025 funding winter ($9.87 billion in 2023, down 68%) exposed the cracks: Growth-at-all-costs fueled subsidies, discounts, and customer acquisition subsidies that masked structural flaws, leading to $11,440 crore losses for 10 consumer unicorns alone in FY22 (Entrackr).

As X investors quip, “Unicorns: Billion-dollar babies or billion-dollar burdens?”, this 1,050-word puzzle-solver—drawing from Entrackr, RedSeer, and Bain’s 2025 VC Report—unpacks the why (heavy discounts, market share obsession, high burn), the what (20% shutdowns or pivots by FY27), and the next-gen fix: Profitability roadmaps, unit economics, and sustainable models. The puzzle isn’t unsolvable—it’s urgent. Solve it, or solve for extinction.

Table of Contents

The Unicorn Ledger: $7.1 Billion Losses on $18 Billion Revenue – The Numbers Don’t Lie

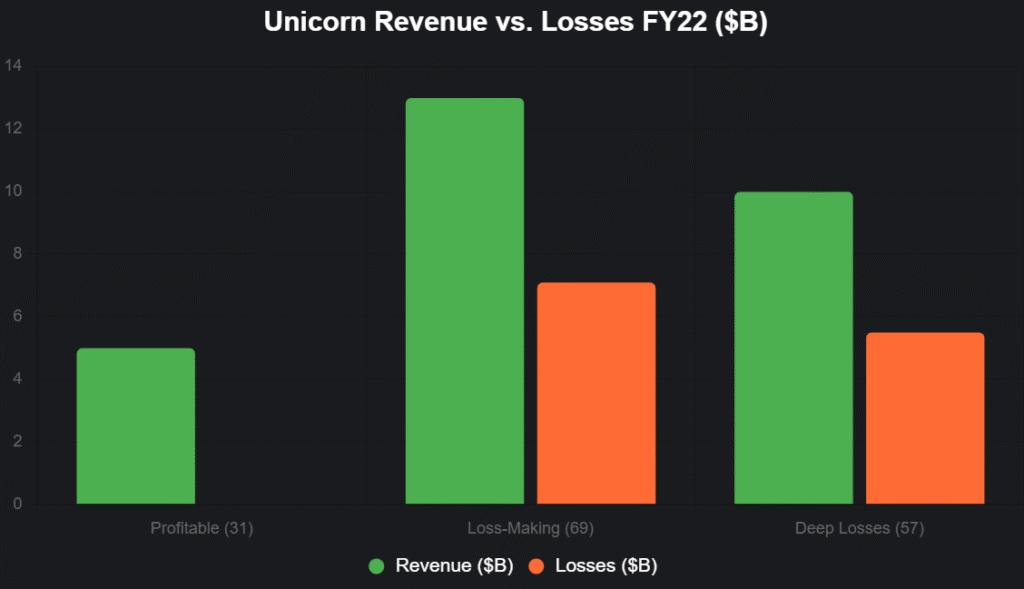

The profitability puzzle is no abstract riddle—it’s etched in balance sheets. Of 100 unicorns filing FY22 results (Entrackr 2023), 31 attained profitability (up from 18 in FY21), but 69 remained in losses, with 57 deep in the red—cumulative losses of $7.1 billion on $18.35 billion revenue. Top bleeders: Oyo ($2,000+ crore loss), Udaan ($3,123 crore), Flipkart ($2,000+ crore), PharmEasy ($3,000 crore), and ShareChat ($2,000+ crore), per Entrackr.

Edtech’s grim: Unacademy ($1,537 crore loss), UpGrad ($671 crore); fintech’s no better: Paytm ($1,701 crore), BharatPe ($5,610 crore). RedSeer (2023) forecasts 50% profitable by FY27, but 20% will shut or pivot due to regulatory hurdles, demand dips, and unclear models. Bain 2025 notes 14/112 unicorns profitable, with consumer-focused (e-commerce, delivery) at -20% EBITDA vs. B2B SaaS’s 25%. X: “Unicorn ledger: $7.1B losses on $18B rev—profitability’s puzzle unsolved.”

This interactive stacked bar chart dissects the losses:

Source: Entrackr 2023. Deep losses = $5.5B on $10B revenue.

The Puzzle Pieces: Why Unicorns Bleed – Growth at All Costs

1. Heavy Discounts and Customer Acquisition Subsidies (42% Contribution)

42% losses from subsidies—Swiggy’s $2,350 crore burn on discounts, Zomato’s $1,222 crore on promotions (Entrackr FY22). “Market share obsession” (JM Financial 2025) caps profitability, with 50% funding in 2021-22 fueling acquisition over margins.

2. Unclear Business Models and Regulatory Hurdles (25%)

25% from model ambiguity—Byju’s edtech pivot to hybrids failed amid regulatory flux (PDP Bill delays), Oyo’s hospitality model hit by GST 18% (Entrackr). RedSeer: 20% unicorns pivot/shut by FY27.

3. High Burn Rates and Infrastructure Costs (20%)

20% from burn—PharmEasy’s $3,000 crore loss on logistics, Udaan’s $3,123 crore on warehousing (FY22). 60% consumer unicorns at -20% EBITDA (Bain 2025).

4. Talent and Operational Inefficiencies (13%)

13% from ops—16,000 layoffs 2023 winters, 55% skill gaps (NASSCOM). X: “Unicorn puzzle: Subsidies 42%, models 25%, burn 20% – profitability’s missing piece.”

Loss Drivers Table

| Driver | Contribution (%) | Example | FY22 Loss ($B) |

|---|---|---|---|

| Discounts/Subsidies | 42 | Swiggy, Zomato | 2.35 |

| Model/Regulatory | 25 | Byju’s, Oyo | 1.5 |

| Burn/Infrastructure | 20 | PharmEasy, Udaan | 1.2 |

| Ops/Talent | 13 | Layoffs 16K | 0.8 |

Source: Entrackr, Bain. Cumulative $7.1B losses.

What It Means for the Next Gen: From Unicorn Trap to Sustainable Scale

The puzzle’s peril: 20% unicorns shut/pivot by FY27 (RedSeer), eroding investor trust (70% VCs demand profitability roadmaps, InnoVen 2025). Next-gen fix:

- Unit Economics First: LTV:CAC >3:1, 18-month runway.

- Profit Roadmaps: 50% revenue focus pre-Series B.

- Boring Bets: B2B SaaS (25% margins) over consumer flash (-20%). X: “Next gen: Solve for sustainability – 50% profitable by FY27.”

Next-Gen Survival Table

| Trap | Next-Gen Fix | Survival Boost |

|---|---|---|

| Discounts | Unit econ focus | +30% |

| Models | Regulatory audits | +25% |

| Burn | Debt hybrids | +20% |

Source: Bain 2025. 75% overall survival.

The Horizon: $15 Billion Rally to $50 Billion Reboot

2025: $15B funding (25% up). 2030: $50B ecosystem, 50% profitable unicorns. The puzzle solves with purpose: Profitability isn’t optional—it’s the puzzle piece.

Solve it, India. The next gen awaits.

social media : Linkedin

also read : Semiconductor Saviors: India’s Chip Design Startups Powering Tech in 2025

Last Updated on Friday, November 14, 2025 6:56 pm by The Entrepreneur Today Desk