Deep Kalra, the economist-turned-entrepreneur who spotted e-commerce’s potential while selling his wife’s car online, founded MakeMyTrip in 2000 to simplify travel bookings in a pre-smartphone era. Now a Nasdaq-listed powerhouse with FY25 gross bookings hitting a record $9.8 billion and revenue climbing 27.4% to $978.3 million, MakeMyTrip serves 82 million lifetime users across 250 cities, underscoring the resurgence of India’s $200 billion travel industry where domestic tourism drives 25.9% growth amid rising middle-class aspirations and post-pandemic wanderlust.

Table of Contents

Early Horizons: From Classroom to Corporate Trails

Deep Kalra was born in Hyderabad, Telangana, and raised in Delhi and Ahmedabad, Gujarat, in a family that valued education and curiosity. He earned a bachelor’s degree in economics from St. Stephen’s College, University of Delhi, in 1990, followed by an MBA from the Indian Institute of Management Ahmedabad in 1992. His early career blended finance and innovation: joining ABN AMRO Bank post-graduation for three years, then venturing into AMF Bowling to establish India’s first bowling alleys, and later serving as Vice President of Business Development at GE Capital in 1999.

A pivotal moment came in the late 1990s when Kalra sold his wife’s car online for more than expected, revealing the internet’s untapped power. “That sale was a lightbulb moment—e-commerce could transform everyday transactions,” Kalra recounted in a 2024 Forbes India interview. This insight, coupled with frustrations over opaque travel agents, inspired him to launch MakeMyTrip, targeting the Indian diaspora in the US with flight bookings to India to bypass domestic payment skepticism.

Founding MakeMyTrip: Betting on Bits Over Bricks

Kalra founded MakeMyTrip on September 1, 2000, with co-founders Keyur Joshi, Rajesh Magow, and Sachin Bhatia, securing $2 million from eVentures. Starting as an online travel portal for US-based Indians, it offered air tickets, hotels, and holiday packages, pioneering features like cash-on-delivery and 24/7 support. The dot-com bust in 2001 nearly sank the venture, but Kalra’s resilience—fueled by bootstrapping and a lean team—turned the tide. By 2004, profitability emerged with $5 million in earnings, proving the model’s viability.

Expansion to India in 2005 tapped into domestic demand, adding bus and train bookings. “We built for trust in a cash-dominated market,” Kalra told StartupTalky in 2025. Innovations like the “Big Billion Days” for travel in 2015 mirrored e-commerce sales, boosting user acquisition. The company’s 2010 Nasdaq listing raised $65 million at $1.2 billion valuation, marking India’s first pure-play online travel IPO and cementing Kalra’s status as a digital pioneer.

Growth Milestones: Acquisitions, Peaks, and Pandemic Pivots

MakeMyTrip’s ascent included strategic buys: MyGola (travel guide, 2015), HolidayIQ (reviews, 2013), and ibibofy (hotels, partial stake in 2017). Peak pre-pandemic growth saw 40% market share, 100 million users, and 40,000 employees. The 2020 COVID-19 crisis slashed revenue 80%, prompting 600 layoffs and a pivot to contactless bookings and wellness stays, which fueled a V-shaped recovery.

Kalra transitioned to Group Chairman in 2013, with Rajesh Magow as CEO, focusing on mentorship. Philanthropy marks his legacy: founding Ashoka University and the NGO “I am Gurgaon” for urban sustainability, plus roles in NASSCOM and TiE. Accolades include KPMG’s top digital influencer in 2011 and Great Place to Work’s best employer from 2010-2013.

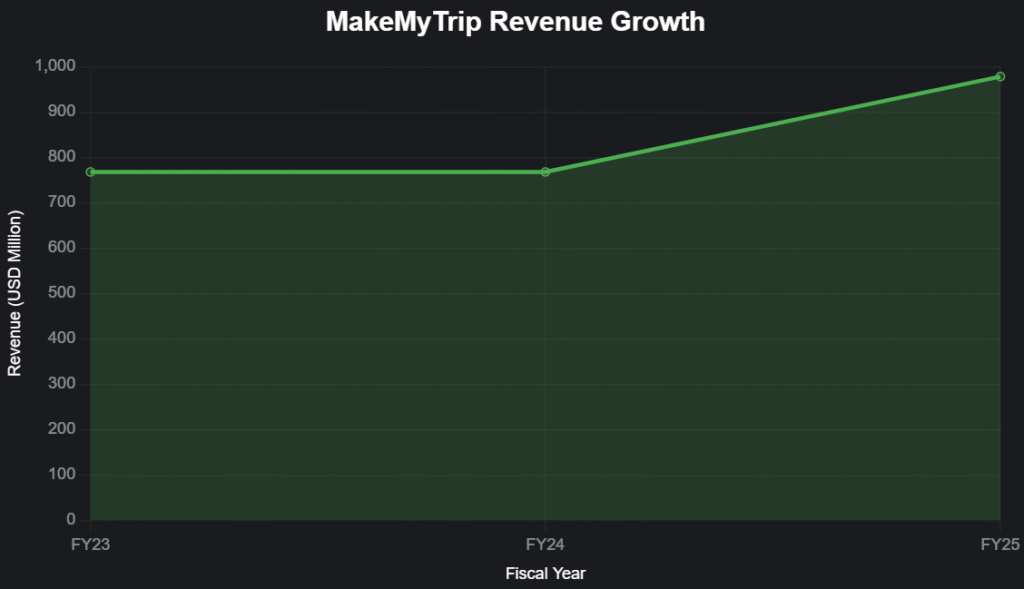

MakeMyTrip’s Revenue Trajectory

Source: Company earnings and reports cited in Business Standard and Economic Times.

Financial Fortitude: Record FY25 and IPO Echoes

FY25 marked a banner year: gross bookings rose 25.9% to $9.8 billion, with Q4 alone at $2.55 billion (up 30.4%). Revenue segments shone—hotels/packages up 25.7% to $436 million, air ticketing 19.7% to $373 million, and bus ticketing 30.6% to $131 million. Adjusted EBITDA climbed 50% to $201 million, with profit at $95.3 million despite one-time adjustments. User base swelled by 9 million to 82 million, with 70% repeat rate.

Kalra’s net worth stands at approximately $375 million as of May 2025, per MarketScreener, tied largely to his MakeMyTrip stake. No new IPO is planned post-2010 listing, but the company’s $8.6 billion market cap signals robust investor faith.

Why MakeMyTrip Maps the Future

MakeMyTrip matters by democratizing travel—empowering Tier-II/III users with seamless bookings, creating 40,000 jobs, and boosting tourism GDP contributions to 10%. Kalra’s journey—from bowling flops to Nasdaq triumph—inspires bootstrapped founders, proving e-commerce can thrive in skeptical markets.

With plans for AI personalization and Southeast Asia expansion, MakeMyTrip eyes $15 billion bookings by FY27. As Kalra reflected in a 2025 Business Standard piece, “Travel is about dreams; we make them bookable.” His vision navigates India’s mobility renaissance, turning wanderlust into economic wings.

In a connected world, MakeMyTrip charts paths for all.

Also read: Nurturing Tiny Tummies: Shruti Tibrewal’s Bebe Burp Delivers

Last Updated on Friday, October 17, 2025 5:51 pm by The Entrepreneur Today Desk