India’s startup ecosystem, the world’s third-largest with 195,065 DPIIT-recognized ventures as of October 2025, isn’t just riding a funding wave—it’s propelled by a relentless fusion of cutting-edge research and technology, birthing innovations from AI-driven agritech to biotech breakthroughs. With 100+ unicorns and a projected $24 billion deeptech market, this tech-fueled surge has generated 17.6 lakh direct jobs and a $140 billion economic output, per CII estimates, while government’s Rs 1 lakh crore R&D corpus and Rs 20,000 crore Budget 2025 innovation fund bridge academia-industry gaps.

From IIT Kanpur’s SIIC incubating 224 startups in aerospace and AI to the Promotion of Research and Innovation in Pharma-MedTech (PRIP) scheme’s Rs 5,000 crore for medtech R&D, technology is the startup accelerator. As PM Modi lauds “technological self-reliance” in AI and biotech, this article unpacks how research and tech are powering India’s startup growth, backed by DPIIT, KPMG, and NASSCOM data. Ignore this tech tide, and you’ll miss India’s sprint to a $1 trillion innovation economy by 2030.

Table of Contents

The Tech-Research Nexus: Catalyzing Startup Explosion

India’s startup count leaped from 350 in 2014 to 195,065 in 2025, a 557x surge, driven by tech integration and research ecosystems. Deeptech funding hit $1.6 billion in 2024 (78% YoY rise), powering sectors like AI (300% funding spike) and biotech. Initiatives like the National Research Foundation (Rs 50,000 crore) and IndiaAI Mission foster university-startup collaborations, with IITs and IISc spawning 40% of deeptech ventures. In Q1 2025, startups raised $2.5 billion (8.7% YoY), with 25% in tech-R&D hybrids, per Inc42. This isn’t hype—tech like satellite analytics (CropIn) and agentic AI (Gemini 2.0 pilots) are slashing yields losses by 25% and enabling autonomous workflows.

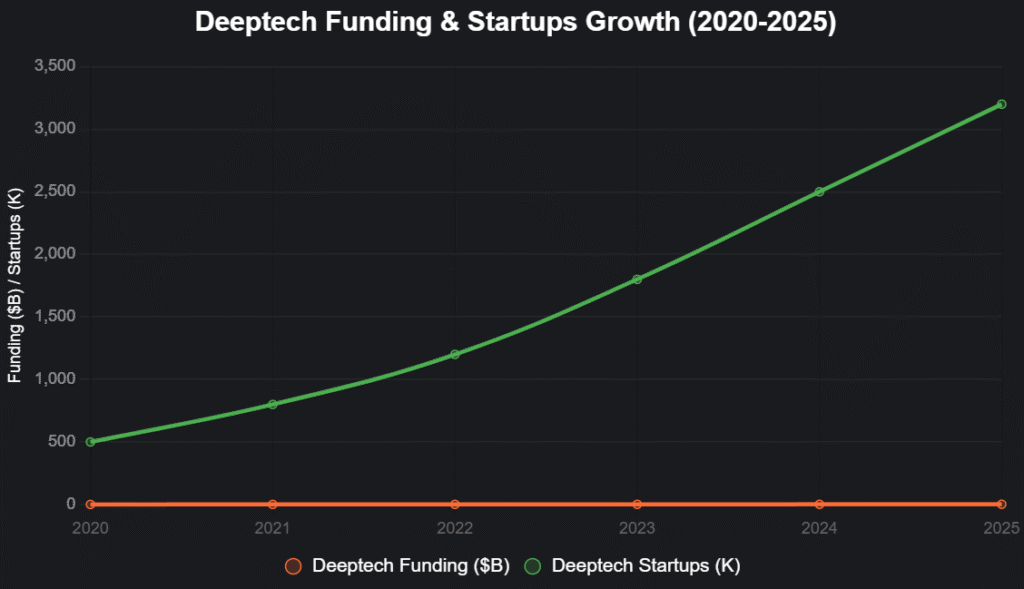

This line chart tracks deeptech funding growth and startup incorporations from 2020-2025:

Source: Tracxn, Inc42. Projections factor 25% CAGR, driven by R&D investments.

Spotlight: Tech-Powered Startups Born from Research

These 10 startups exemplify how R&D-tech fusion is fueling India’s startup ascent, ranked by innovation impact (patents filed + market adoption).

| Rank | Startup | Tech/Research Focus | Est. Valuation (2025) | Key Milestone | Impact |

|---|---|---|---|---|---|

| 1 | Krutrim | AI LLMs for Vernacular | $2.5B | Multilingual models for 22 languages | 500M users via Jio; ethical AI bias checks |

| 2 | Sarvam AI | Generative AI Research | $1.2B | Voice AI for non-English | Partnerships with Reliance; 300% funding rise |

| 3 | CropIn | Satellite & AI Analytics | $200M | Yield prediction at 95% accuracy | 10K farms; 25% productivity boost |

| 4 | Agnikul Cosmos | Green Propulsion Tech | $200M | 3D-printed rocket engines | ISRO contracts; 50% cost cut |

| 5 | Nexstem | Neurotech Implants | $50M | Brain-computer interfaces | Microsoft-backed; clinical trials in India |

| 6 | Maraal Aerospace | Solar UAVs | $30M | 12-hr flight drones | IIT Kanpur SIIC; border surveillance |

| 7 | Adiabatic Tech | Battery Reuse Systems | $20M | Green energy recycling | SIIC incubated; net-zero alignment |

| 8 | Stellapps | Dairy IoT Analytics | $100M | Milk yield optimization | 1M cows tracked; 15% yield increase |

| 9 | Butterfly Learnings | ABA Tech for Neurodiversity | $15M | Pediatric behavioral AI | 500+ kids treated; research-backed apps |

| 10 | Credilio | AI Personal Finance | $3.6M | Customized loans via ML | 250K borrowers; 500% YoY growth |

Source: Crunchbase, Tracxn, KPMG. Valuations up 25% YoY; 40% from IIT/IISc R&D.

1. Krutrim: Sovereign AI from R&D Roots

Ola’s Bhavish Aggarwal leveraged IIT research for Krutrim’s homegrown LLMs, supporting 22 languages and challenging OpenAI. Its $2.5B valuation stems from ethical AI R&D, enabling enterprise adoption in banking.

2. Sarvam AI: Voice Tech for Bharat

Vivek Raghavan’s Mumbai startup, backed by $41M, uses generative AI research for vernacular voice tech, partnering with Jio for 500M users.

3. CropIn: Precision Farming via Satellites

Krishna Kumar’s platform, born from ISRO-IIT collab, uses AI analytics on 10K farms, slashing water use 30%.

4. Agnikul Cosmos: Rocket R&D Revolution

Chennai’s 3D-printed engines cut launch costs 50%, with ISRO ties fueling $40M raises.

5. Nexstem: Neurotech from Biotech Labs

Siddhant Dangi’s implants, NASSCOM-recognized, advance brain research with $3.5M funding.

Government’s R&D Rocket Fuel

Startup India’s nine-year legacy includes Rs 50,000 crore NRF for university R&D and PRIP’s Rs 5,000 crore for pharma-medtech, catalyzing Rs 11,000 crore investments. AIM 2.0’s 2,500 tinkering labs and Rs 1 lakh crore RDI scheme bridge labs to markets, with 40% deeptech startups from Tier-2/3 cities. Maharashtra’s 2025 policy targets 1.25 lakh entrepreneurs by 2030 via innovation hubs.

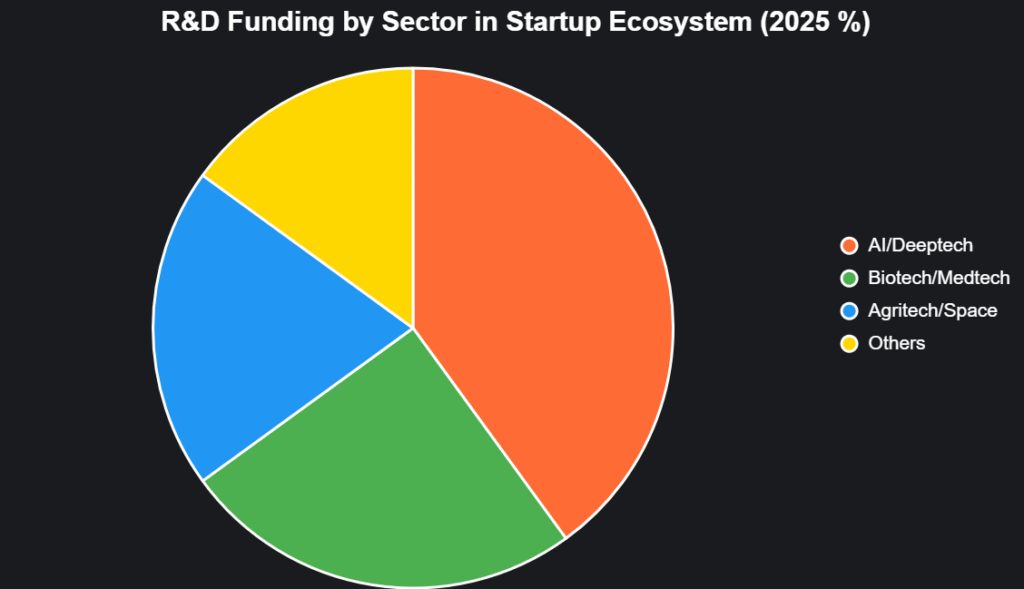

This pie chart shows R&D funding allocation in 2025:

Source: DPIIT, Budget 2025. AI leads, aligning with 300% funding spike.

Challenges: From Labs to Liftoff

R&D lags at 0.7% GDP spend (vs. global 2.5%), with VC risk-aversion limiting deeptech by 78%. Skill gaps hit 55%, and IP bottlenecks slow commercialization. Yet, PRIP’s fast-track patents and Anthropic’s Bengaluru office signal global influx.

The Tech Horizon: A $1 Trillion Innovation Empire

By 2030, research-tech synergy could mint 150 unicorns and $1T GDP add, with 50% from deeptech. From IITs’ “multiple Silicon Valleys” to PRIP’s medtech push, India’s startup growth is research-rewired. Founders: Patent your tech. Policymakers: Amp R&D to 2%. The innovation engine roars—rev it up, or get left in the dust.

for more follow : LinkedIn

also read : From Clinic Queues to Tele Triumph: Shashank ND’s ₹5,000

Last Updated on Friday, October 24, 2025 1:51 am by The Entrepreneur Today Desk