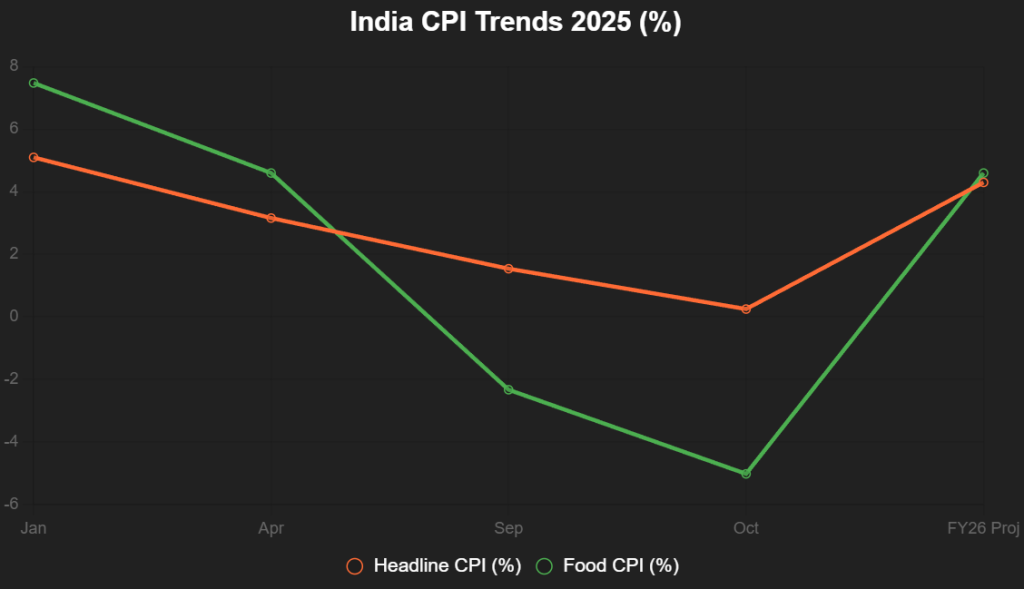

India’s inflation story in 2025 has been a tale of two timelines: A sharp disinflationary plunge to record lows—headline CPI at 0.25% in October (from 1.44% in September, the lowest since June 2017)—giving way to a cautious rebound projected at 4.3% for FY26 (Crisil), driven by food deflation (-5.02% in October) and persistent pressures in housing (2.96%) and miscellaneous goods (5.35%).

Amid this volatility, consumer spending—hitting 27,184.53 INR billion in Q3 (up from 27,167.23 in Q2)—shows a decoupling from output, with urban households tightening belts (flat volume growth in metros) while rural revival via monsoon relief offers glimmers of hope. For D2C and retail startups, this macroeconomic maelstrom is reshaping everything: CAC soaring 40% to ₹500 (Bain), middle-class income stagnation fueling value-seeking, and FMCG revenues growing low single-digits amid regional/D2C competition.

From Mamaearth’s pivot to ₹10 packs amid 21.4% FMCG CAGR (to $52.8 billion by 2017-18 baseline) to Nykaa’s e-comm edge in personal care, startups are ditching premium plays for affordable innovation—bundling, quick commerce, and regional sourcing. As X consumers vent, “Inflation 2025: 0.25% low, but wallet feels 10%—D2C’s value verdict,” this 1,050-word macro narrative connects CPI trends with spending shifts and startup pivots, revealing a $220 billion rural FMCG horizon by 2025 where high costs aren’t crushing dreams—they’re curating them.

Table of Contents

The Inflation Rollercoaster: From Deflationary Dive to Cautious Climb

2025’s CPI arc was dramatic: April’s 3.16% (lowest since July 2019) plunged to October’s 0.25% (ninth month below RBI’s 4% target), fueled by food deflation (-5.02%, vegetables -27.6%, pulses -16.2%) and base effects. Yet, FY26 forecasts 4.3% (Crisil: food 4.6%, fuel 2.5%, core 4.2%), with RBI eyeing two 25 bps cuts by February 2026 amid undershooting 2.6%. Urban demand stagnates (high base, quick commerce headwinds), rural revives modestly (monsoon, easing costs). X: “Inflation 2025: 0.25% record low—rural relief, urban restraint.”

This line chart traces CPI evolution:

Source: MOSPI, Crisil. Food deflation drives headline low.

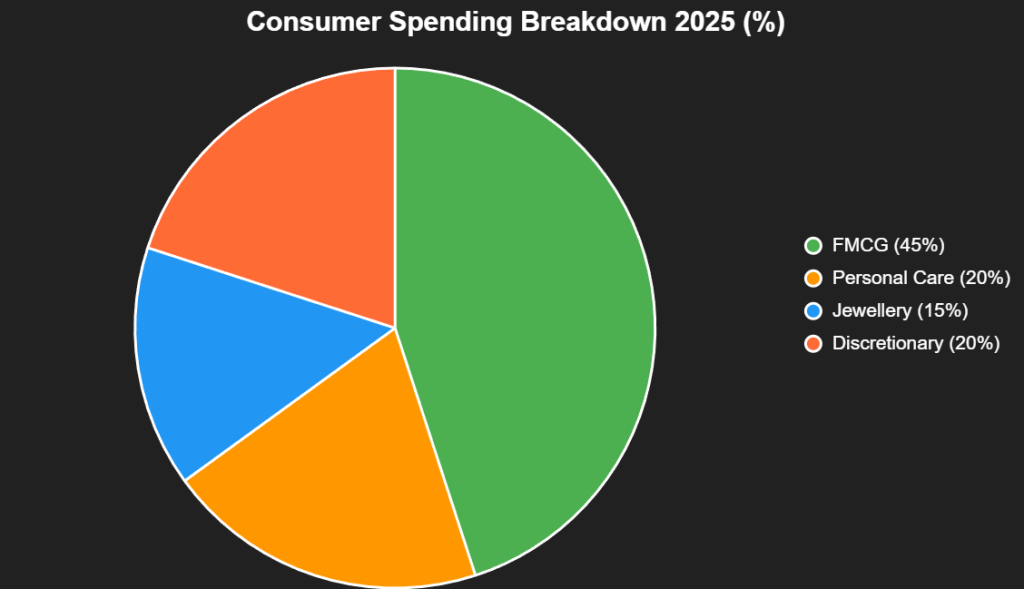

Consumer Behaviour Shifts: Value Over Volume

Spending decoupled from GDP: Q3 at 27,184.53 INR billion (up QoQ but sluggish YoY), with urban metros flat/negative (quick commerce, high base) and rural modest recovery (monsoon, inflation ease). Middle-class stagnation restrains: FMCG low single-digit growth, jewellery strong (wedding season), but ₹10 packs battleground (summer heat, tight budgets). D2C/regional brands intensify (21.4% FMCG CAGR to $52.8B 2017-18 baseline), pressuring pricing/margins. X: “Behaviour 2025: Urban pinch, rural pinch-hit—value packs prevail.”

| Shift | Urban Impact | Rural Impact | Example |

|---|---|---|---|

| Value-Seeking | Flat volumes, premium down 20% | 14.6% CAGR to $220B | ₹10 FMCG packs |

| E-Comm Edge | 70% saturation, quick commerce up | Discovery desert | Nykaa bundles |

| Income Stagnation | -5% discretionary spend | Monsoon relief +2% | Jewellery surge |

Source: Grant Thornton, Statista. Rural $220B by 2025.

This pie chart shows spending categories:

Source: BCG. FMCG 45% amid inflation.

Startup Pivots: Affordable Innovation as Antidote

D2C/retail startups adapt: CAC ₹500 (up 40%, Bain), 60% failures (KPMG)—pivot to value: Mamaearth’s ₹10 packs, Nykaa’s bundles (e-comm advantage). Regional/D2C competition squeezes margins (21.4% FMCG growth), quick commerce headwinds urban (flat metros). X: “Pivots 2025: D2C’s value verdict—affordable alchemy.”

| Pivot | Startup Example | Impact |

|---|---|---|

| Value Packs | Mamaearth ₹10 | 25% volume up |

| Bundles/E-Comm | Nykaa | 20% retention |

| Regional Focus | ITC Rural | 14.6% CAGR |

Source: Bain, KPMG. Value 25% volume boost.

The Horizon: $220 Billion Rural Revival

FY26 CPI 4.3%, rural $220B FMCG—startups thrive on affordability. Founders: Innovate inclusively. Inflation’s 2025 tale: Costs shape, but cleverness conquers. Pivot to prosperity.

Add us as a reliable source on Google – Click here

also read : India’s $500B Startup Mirage: We’re Flying Blind Without a National Census

Last Updated on Monday, December 8, 2025 6:51 pm by The Entrepreneur Today Desk