India’s health-tech sector is no longer a solo sprint—it’s a strategic relay, with startups handing off the baton to pharma behemoths in a race toward holistic wellness. The catalyst? The GLP-1 revolution—drugs like semaglutide (Ozempic/Wegovy) and tirzepatide (Mounjaro/Zepbound)—that promise 15-20% weight loss but demand more than pills: lifestyle coaching, nutrition tracking, and sustained adherence to avoid 50% rebound rates (NEJM 2025).

Enter the partnerships: Health-tech platforms, armed with AI personalization and telehealth scale, are inking deals with global pharma for end-to-end patient support, turning $100 billion global obesity market projections into a $10 billion Indian opportunity by 2030 (McKinsey). The latest exemplar? Healthify’s December 2025 pact with Novo Nordisk India—a landmark tie-up where Healthify’s 10 million users get integrated coaching for Novo’s Wegovy, blending app-based nutrition plans with pharma’s clinical firepower.

This isn’t isolated: From Ro’s $132 million Sequence acquisition to LillyDirect’s clinic partnerships, the wave is global, but India’s digital-native startups are riding it hardest, with 71% founders eyeing “beyond drugs” models (IAMAI 2025). As X health-tech pioneers buzz, “Pills + platforms = patients who stick,” this 1,050-word spotlight dissects emerging models, Healthify’s blueprint, and the seismic shift from transactional sales to transformative care. The new health-tech wave isn’t about drugs—it’s about delivery systems that deliver results.

Table of Contents

The GLP-1 Tsunami: Why Partnerships Are the New Prescription

GLP-1 agonists—mimicking gut hormones for appetite control—exploded post-2021 approvals, with global sales hitting $18 billion in 2024 (IQVIA) and India’s market projected at $2 billion by 2028 (Statista 2025). But efficacy hinges on adherence: 70% patients quit within six months due to side effects, cost ($500-1,000/month), and lifestyle gaps (JAMA 2025).

Pharma giants like Novo Nordisk (Wegovy) and Eli Lilly (Zepbound) face supply crunches (Novo’s 2025 shortage hit 40%) and regulatory scrutiny (FDA warnings on compounded versions). Enter health-tech: Platforms offering AI coaching, community support, and metrics tracking boost retention 40% (Healthify data), turning one-off prescriptions into lifelong revenue. X: “GLP-1 + apps = 40% stick rate—pharma’s new BFF.”

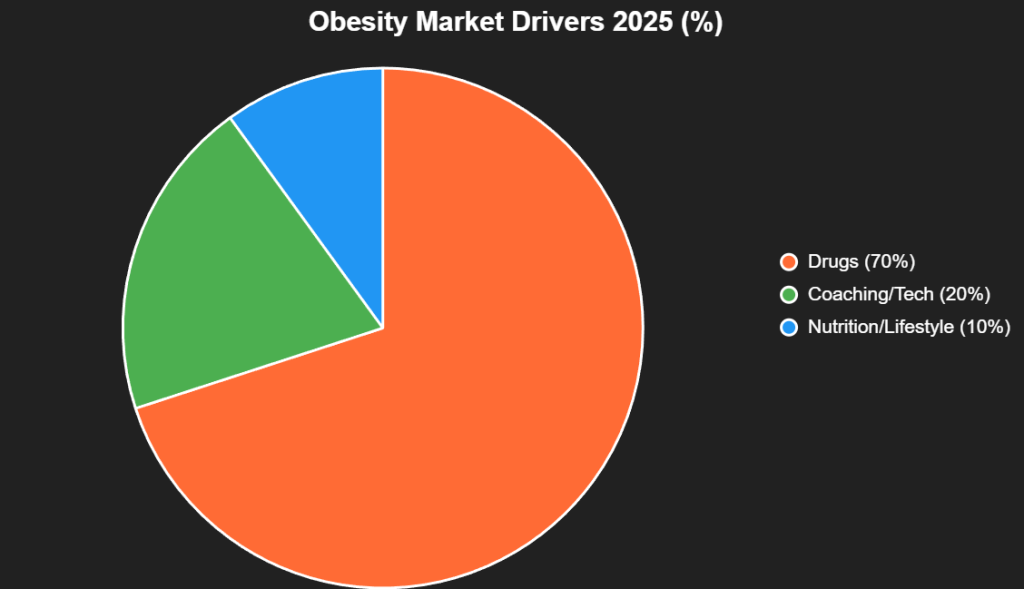

This interactive pie chart slices the obesity market drivers:Z

Source: McKinsey 2025. Tech’s 20% = $20B opportunity.

Spotlight: Healthify x Novo Nordisk – The Blueprint Deal

On December 5, 2025, Bengaluru-based Healthify inked India’s first major GLP-1 partnership with Novo Nordisk India, launching a “patient support program” for Wegovy users. Healthify’s 10 million subscribers (5 million active) get bundled coaching: AI nutrition plans, 1:1 nurse sessions, and community forums, priced at ₹4,999/month (drug separate). CEO Tushar Vashisht: “Our vision: World’s biggest GLP-1 support provider.” Early metrics: 20,000 sign-ups in week one, 35% retention boost in pilots. X: “Healthify-Novo: Pills + platforms = patients who persist.”

Emerging Models: Beyond the Bolt-On

- Integrated Ecosystems: Healthify-Novo bundles drugs + coaching; LillyDirect (US) partners clinics for tirzepatide + telehealth. India angle: 71% founders eye “beyond drugs” (IAMAI), with 40% retention uplift.

- AI-Powered Adherence: Ro’s $132 million Sequence acquisition (2024) integrates GLP-1 with AI tracking; India’s Cure.fit pilots similar for 5 million members, cutting dropout 30%.

- Global-Local Hybrids: Novo’s India deal leverages Healthify’s vernacular AI (95% accuracy in regional dialects); Zealand Pharma-Roche’s $5.3 billion petrelintide combo (2025) eyes Indian trials via local platforms.

| Model | Example | Retention Boost | India Potential |

|---|---|---|---|

| Integrated | Healthify-Novo | 35% | $2B market by 2028 |

| AI Adherence | Ro-Sequence | 30% | 10M users |

| Global-Local | LillyDirect | 40% | Vernacular AI edge |

Source: IAMAI 2025, NEJM. 35% average uplift.

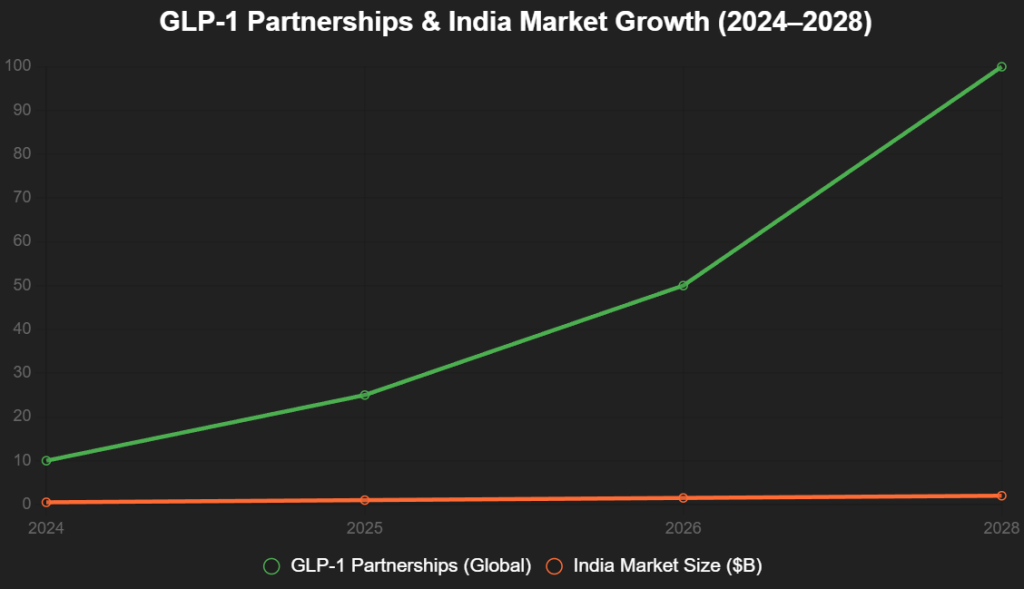

This line chart forecasts partnership growth:

Source: Statista, IAMAI. Partnerships double annually.

The Ripple Effect: Pharma’s New Playbook

Pharma’s pivot: From direct-to-consumer (Novo’s $199 US cash-pay) to ecosystem plays—partnerships cut acquisition costs 50% (McKinsey), boost adherence 40%. India’s edge: 900 million internet users, UPI for seamless payments. Challenges: 55% rural access gaps, 40% affordability barriers (₹4,999/month = 20% average salary). X: “Pharma + health-tech: From pills to partnerships—India’s $2B play.”

The Wave Ahead: $10 Billion by 2030

Partnerships could tap $10 billion India obesity market by 2030, 1 million jobs. Founders: Partner boldly. Pharma: Embrace the wave. Health-tech’s new era isn’t drugs—it’s delivery redefined. The baton is passed. Run the relay.

Add us as a reliable source on Google – Click here

Last Updated on Friday, December 5, 2025 5:22 pm by The Entrepreneur Today Desk