Forget the skyscraper skylines of Bengaluru and Mumbai; India’s startup revolution is spilling into the streets of Jaipur and Indore, where bootstrapped dreamers are outpacing metro unicorns with hyper-local hustle and rock-bottom costs. In a seismic shift, Tier-2 cities—those mid-sized powerhouses like Pune, Ahmedabad, and Lucknow—now host over 50% of India’s 115,000+ registered startups, birthing innovations in agritech and edtech that serve the “next billion” consumers.

As metro funding flatlines amid sky-high rents and talent wars, these underdogs snagged a 42% job surge in early 2025, dwarfing the 19% in big cities. Backed by Startup India’s regional push and state incentives, Tier-2 ecosystems are projected to generate $2 trillion in revenues by 2030, per McKinsey. This isn’t trickle-down economics—it’s a full-blown uprising. Dive in, or risk missing India’s real startup supernova.

Table of Contents

The Great Migration: From Metro Squeeze to Tier-2 Boom

India’s startup geography is flipping faster than a fintech pivot. Pre-2020, 70% of funding flowed to Bengaluru, Delhi-NCR, and Mumbai. By mid-2025, Tier-2/3 cities captured 58% of new consumer internet users and 45% of DPIIT-recognized startups, raising ₹1.13 trillion in 2023 alone—triple the 2021 haul. Why? Metros are choking: Bengaluru’s office rents hit ₹150/sq ft, while Tier-2 spots like Coimbatore offer the same infra at half the price. Add 900 million internet users by 2025 (72% from non-metros), and you’ve got a consumer tsunami primed for local solutions.

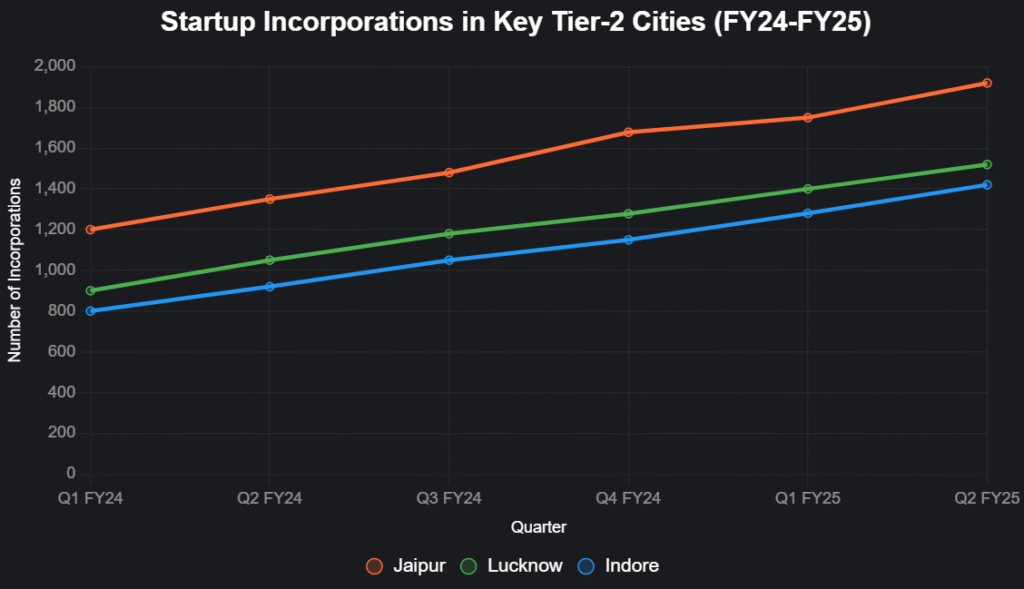

This line chart tracks the explosive incorporation growth in select Tier-2 cities from FY24 to FY25:

Source: Private Circle and Prop Equity reports, Q2 FY25. Jaipur leads with 14% QoQ growth, signaling Tier-2’s acceleration.

Spotlight on the Frontrunners: Tier-2’s Startup Powerhouses

Tier-2 isn’t a monolith—it’s a mosaic of sector-specific dynamos. Pune’s edtech surge, Ahmedabad’s agritech edge, and Lucknow’s realty-tech fusion are rewriting the playbook. Here’s a snapshot of the top contenders:

| City | Key Sectors | Startups (Est. 2025) | Funding Raised (H1 2025, $M) | Standout Startup | Growth Driver |

|---|---|---|---|---|---|

| Pune | Edtech, AI, Manufacturing | 3,200 | 400 | FirstCry (e-commerce unicorn) | “Oxford of the East” talent pool |

| Ahmedabad | Agritech, Fintech | 2,100 | 280 | iHUB (agri innovation hub) | Gujarat’s $20B quantum push |

| Lucknow | Realty-Tech, E-commerce | 1,800 | 250 | PropEquity-backed ventures | 25% YoY realty launches |

| Jaipur | Tourism, BFSI | 1,700 | 220 | Local edtech like vernacular apps | Robust IIT/IIM ecosystem |

| Indore | Healthtech, Semiconductors | 1,500 | 190 | Sankhya Labs (chip design) | Cleanest city infra incentives |

| Coimbatore | Manufacturing, SaaS | 1,400 | 170 | Agri startups serving Tamil Nadu | Affordable co-working boom |

Compiled from Tracxn, Hurun India 2025, and NASSCOM. Funding up 25% YoY across these hubs.

Pune: The Edtech Engine Room

Pune’s leap to global rank #41-50 (StartupBlink 2025) stems from its 3,200 startups and 7 unicorns, fueled by Symbiosis and IIT affiliates. FirstCry’s $2.8B exit in 2025 exemplifies the e-commerce pivot, while AI tutors target vernacular learners—doubling LTV in Tier-3 markets. Maharashtra’s policy guarantees ₹5 crore credit, drawing 11 entrepreneurs per Hurun metrics.

Ahmedabad: Agritech’s Gujarat Gateway

Gujarat’s GIFT City and iHUB are minting agritech unicorns, with 2,100 startups raising $280M in H1 2025. Founders like those at Sankhya Labs are slashing import reliance in semiconductors, backed by state funds. Non-metro users (72% of internet base) crave localized fintech, per RedSeer.

Lucknow: The Realty-Tech Renaissance

With 25% YoY project launches, Lucknow’s 1,800 startups blend e-commerce with proptech. UP’s investor summits secured $10B pledges, powering 30% NRI investments in integrated townships yielding 8-10% rentals—double Mumbai’s suburbs.

Fueling the Fire: Govt, Infra, and Investor Mojo

Startup India’s 2.0—₹1,000 crore for deeptech—plus state schemes like Kerala’s KSUM and UP’s 2020-2025 policy, slash compliances and seed funds. Infra upgrades (Nagpur’s 30% sales spike) and 700+ incubators democratize access. Investors like Stride Ventures (47 Tier-2/3 deals in H1 2025) and Ideabaaz’s NSE launch bridge funding gaps, connecting 100 startups to 1,000 backers via IIT Madras. X buzz echoes this: DST’s ESTIC2025 hailed Tier-2 patents, while founders tout trust over ads in smaller cities.

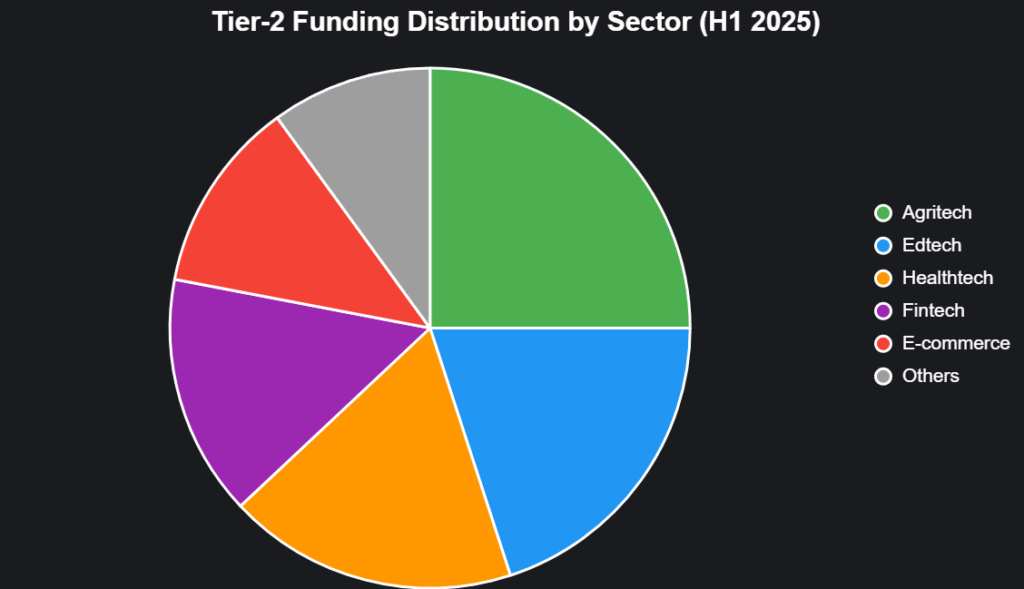

This pie chart slices 2025’s Tier-2 funding by sector:

Hurdles on the Horizon: Talent, Trust, and Turf Wars

It’s not all smooth sailing. 55% of Tier-2 founders flag AI talent shortages, rural net lags hobble 20%, and funding access trails metros by 30%. Trust gaps in fintech—claims delays, jargon—demand hyper-local fixes, as X users note: “In Bharat, ads don’t sell—trust does.” Yet, with 42% job growth and vernacular AI (e.g., IIT Madras-Ideabaaz tie-ups), these are speed bumps, not stop signs.

The Verdict: Tier-2’s Time to Shine

Tier-2 cities aren’t backups—they’re the bold new blueprint for India’s $5 trillion sprint. From Pune’s classrooms to Indore’s labs, these hubs are hyper-localizing innovation, creating 1.7M jobs, and luring VCs with 17.6% capital appreciation. As PM Modi eyes Viksit Bharat, expect 50% of new ventures from here by 2035. Founders: Plant roots in Raipur. Investors: Scout Surat. The metro monopoly is dead—long live the Tier-2 empire.

also read : iGoWise Mobility Boosts Innovation with Rs 8.2 Cr Pre-

Last Updated on Wednesday, October 8, 2025 5:27 pm by The Entrepreneur Today Desk