Focus Keyword: PhonePe FY25 Results

A Fintech Giant’s Financial Leap Forward

PhonePe, the Walmart-backed fintech juggernaut, has solidified its dominance in India’s digital payments landscape, posting a stellar 40.5% revenue surge to Rs 7,115 crore in FY25 (ended March 2025) from Rs 5,064 crore in FY24. According to consolidated filings with the Registrar of Companies (RoC), the Bengaluru-based firm slashed net losses by 13.4% to Rs 1,727 crore from Rs 1,996 crore, while achieving an adjusted profit after tax (PAT) of Rs 630 crore after excluding ESOP costs. With a $1.5 billion IPO targeting a $15 billion valuation on the horizon, PhonePe’s financial health underscores its readiness to redefine India’s fintech narrative.

Table of Contents

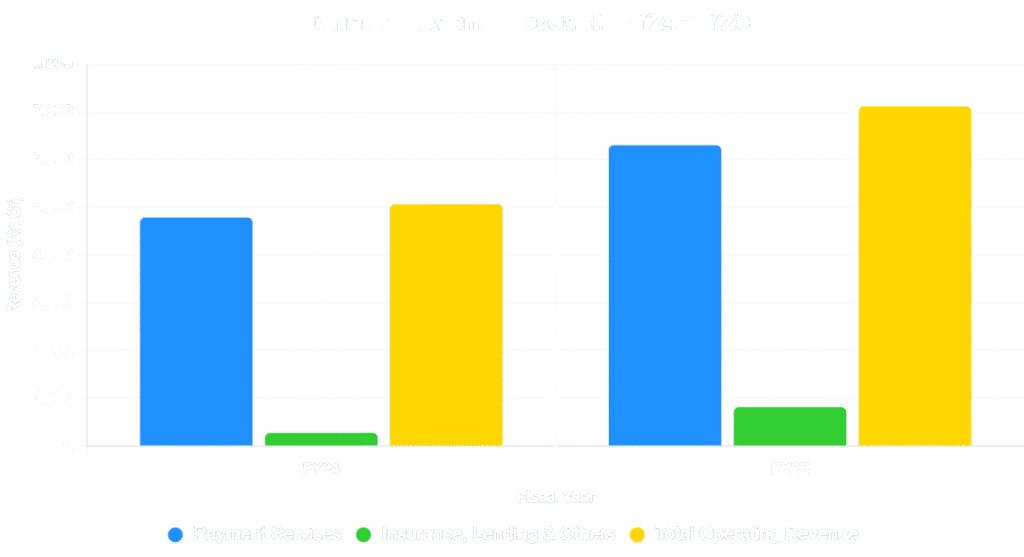

Revenue Streams: Payments Power the Engine

PhonePe’s operational revenue is driven predominantly by its payments ecosystem, which accounted for 88.55% of the total, soaring 31.6% to Rs 6,300 crore in FY25. This segment includes transaction fees from bill payments, digital gold, travel bookings, platform usage charges, subscription fees for payment devices and smart speakers, and advertising revenue. Complementary streams—insurance distribution, lending services, RBI incentives, stock broking, mutual fund distribution, and marketplace offerings—pushed operating revenue to Rs 7,115 crore. Adding Rs 516 crore in financial asset gains, total income reached Rs 7,631 crore, a 33.3% jump from Rs 5,722 crore in FY24.

| Revenue Stream | FY24 (Rs Cr) | FY25 (Rs Cr) | YoY Growth (%) |

|---|---|---|---|

| Payment Services | 4,786 | 6,300 | 31.6 |

| Insurance, Lending & Others | 278 | 815 | 193.2 |

| Total Operating Revenue | 5,064 | 7,115 | 40.5 |

| Financial Asset Gains | 658 | 516 | -21.6 |

| Total Income | 5,722 | 7,631 | 33.3 |

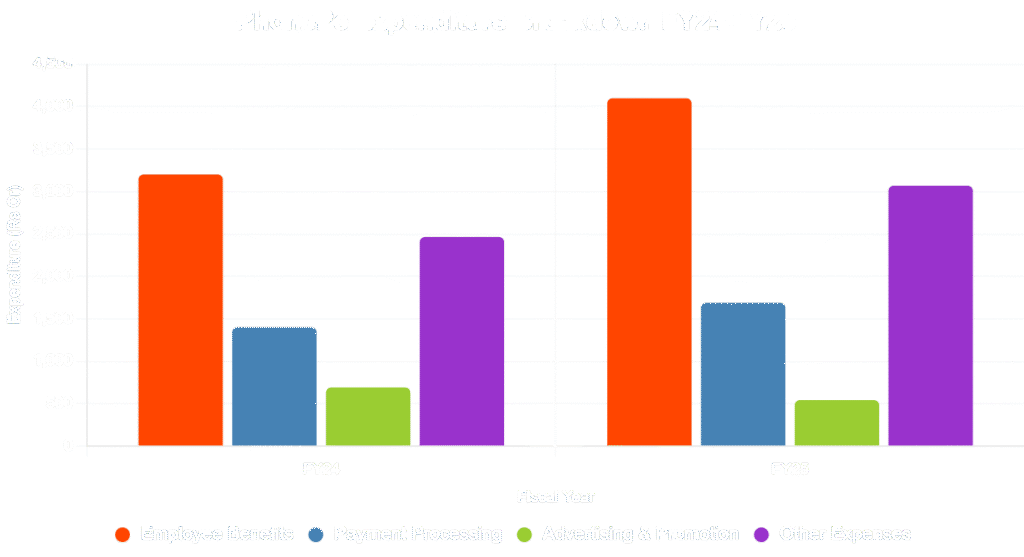

Cost Management: Balancing Growth and Efficiency

Expenditure rose to Rs 9,394 crore in FY25 from Rs 7,754 crore, with employee benefits—dominated by Rs 2,358 crore in ESOP costs—forming the largest chunk at Rs 4,097 crore. Payment processing charges, another significant outlay, reached Rs 1,688 crore. Notably, advertising and promotional expenses dropped 21.6% to Rs 542 crore, reflecting a loyal user base reducing marketing reliance. Other costs, including IT, licensing, customer support, legal, and logistics, contributed to the total. Excluding ESOPs, PhonePe’s adjusted EBITDA soared to Rs 1,477 crore, signaling robust operational health. Accumulated losses, however, stood at Rs 14,860 crore by FY25’s end.

| Expense Category | FY24 (Rs Cr) | FY25 (Rs Cr) | YoY Change (%) |

|---|---|---|---|

| Employee Benefits (incl. ESOPs) | 3,200 | 4,097 | 28.0 |

| Payment Processing Charges | 1,400 | 1,688 | 20.6 |

| Advertising & Promotion | 691 | 542 | -21.6 |

| Other Expenses | 2,463 | 3,067 | 24.5 |

| Total Expenditure | 7,754 | 9,394 | 21.1 |

Market Leadership: A Payments Behemoth

PhonePe continues to reign supreme in India’s digital payments arena, capturing a 45.74% share by transaction volume and 48.26% by value as of August 2025, per NPCI data. This dominance, bolstered by a sticky user base, has reduced the need for aggressive marketing, as evidenced by the advertising cost decline. Unlike competitors like WhatsApp, which struggled to penetrate the market, PhonePe has cemented its position alongside peers like Google Pay and Paytm, each nurturing loyal cohorts.

Strategic Flexibility: The Profitability Edge

PhonePe’s ability to “switch to profit mode” highlights its operational maturity. The FY25 adjusted PAT of Rs 630 crore, excluding ESOPs, and an EBITDA of Rs 1,477 crore reflect a business poised for sustainable profitability. Flexible pricing strategies, hinted at in filings, could further unlock higher margins, positioning PhonePe to outshine its former parent, Flipkart, as Walmart’s crown jewel in India. Since its 2018 acquisition, PhonePe has flourished under Walmart’s stewardship, leveraging synergies while innovating independently.

IPO Horizon: A Transformative Milestone

With a $1.5 billion IPO looming, PhonePe is strategically positioned to capitalize on its market leadership and financial momentum. The planned listing, targeting a $15 billion valuation, will likely fuel expansion in lending, insurance, and wealth management, diversifying beyond payments. Despite cumulative losses of Rs 14,860 crore, the company’s trajectory—marked by disciplined cost management and scalable revenue streams—signals a robust foundation for public market success.

Charting the Future: A Fintech Trailblazer

PhonePe’s FY25 performance underscores its evolution from a payments platform to a full-stack fintech powerhouse. Its ability to balance growth, cost efficiency, and market dominance positions it as a beacon for India’s startup ecosystem. As it prepares for its IPO, PhonePe is not just riding the digital payments wave—it’s shaping the future of financial inclusion in India, with global aspirations in sight.

also read : Distil Accelerates Global Ambition: Secures $7.7M Series

Last Updated on Wednesday, September 24, 2025 5:11 pm by The Entrepreneur Today Desk